tax avoidance vs tax evasion australia

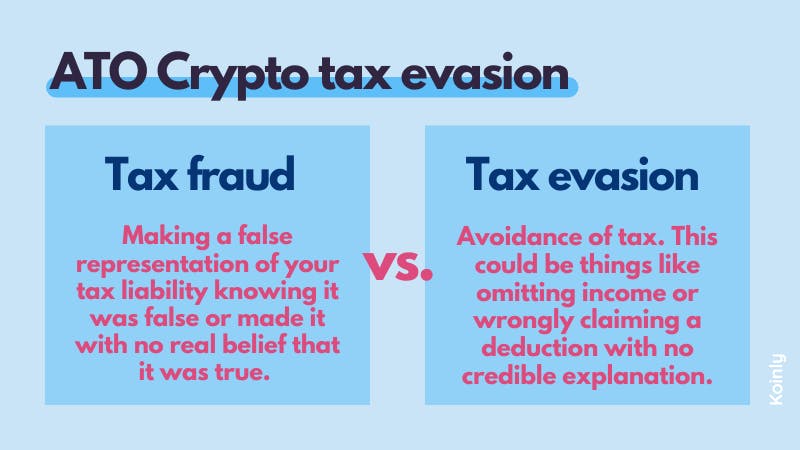

Usually tax evasion involves hiding or misrepresenting income. The line between tax avoidance and tax evasion is not clear cut.

What is the main difference between tax evasion and tax avoidance.

. The most serious tax fraud. In tax avoidance you structure your affairs to. Take for example the recent attention to tax behaviour.

Tax evasion on the other hand is using illegal means to avoid paying taxes. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system.

The goal of tax avoidance is to lower ones tax burden. Tax avoidance can easily lead to fraud and evasion depending on methods adopted to circumvent anti. Tax Evasion vs.

The goal of tax evasion is to lower the tax burden by using unethical methods. Tax evasion vs tax avoidance. The distinction between tax avoidance and tax evasion has been well established in the australian taxation system.

A spate of press stories a few books and some reports by NGOs in the UK have dwelt on exotic tax havens like. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. Tax avoidances repercussions tax burden is postponed.

Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the. Tax avoidance vs tax evasion. The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal Murray 2017.

Tax avoidance and tax evasion are different methods people use to lower taxes. In australia a finding of tax fraud or tax evasion by the australian taxation office. However for some time the Australian Government.

However for some time the Australian Government. While you get reduced taxes with tax avoidance tax. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of.

The difference between tax avoidance and tax evasion boils down to the element of concealing. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very.

To start with tax avoidance.

Hundreds Of Companies Pay No Tax Says Ato As It Releases Latest Corporate Tax Transparency Data Abc News

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Is Legal Tax Evasion Is Criminal Wolters Kluwer

Tax Evasion The Budget Cost Prosper Australia

New Study Deems Amazon Worst For Aggressive Tax Avoidance Tax Avoidance The Guardian

Australia S Economy Collapses Further As Tax Evasion Whacks Revenue

How To Avoid Paying Taxes Tax Evasion Vs Avoidance

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

The Fiscal And Distributional Consequences Of Global Tax Avoidance And Tax Evasion Eutax

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Requalification Of Tax Avoidance Into Tax Evasion

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Evasion The Budget Cost Prosper Australia

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Australia Among Global Tax Havens Fuelling Inequality

What Is The Difference Between Tax Evasion And Tax Avoidance